Small business tax deductions allow businesses to reduce taxable income by writing off eligible expenses, helping them stay compliant and profitable․ This guide navigates maximizing deductions․

1․1 What Are Small Business Tax Deductions?

Small business tax deductions are expenses businesses can subtract from their taxable income, reducing their tax liability․ These deductions include costs like home office expenses, travel, and office supplies, which are ordinary and necessary for business operations․ By leveraging these write-offs, businesses can minimize taxes and maximize profitability․ Proper documentation is essential to ensure compliance with IRS guidelines and avoid audits․ Understanding eligible deductions is crucial for small businesses to optimize their financial strategies and maintain profitability․

1․2 Importance of Tax Deductions for Small Businesses

Tax deductions are vital for small businesses as they reduce taxable income, lowering the overall tax liability․ By claiming eligible expenses, businesses can retain more profits, enhance cash flow, and reinvest in growth․ Deductions also encourage compliance with tax laws and avoid penalties․ Proper documentation ensures businesses maximize their savings while staying within legal boundaries․ Utilizing deductions effectively is essential for financial stability and long-term success, making them a cornerstone of small business financial strategy․

Common Small Business Tax Deductions

Common deductions include home office expenses, car mileage, office supplies, travel costs, and professional fees․ These deductions help reduce taxable income, maximizing savings․ Use the checklist effectively․

2․1 Home Office Deductions

Home office deductions allow businesses to deduct a portion of home expenses if used regularly for work․ This includes rent, utilities, and internet․ The IRS offers two methods: the simplified option, which allows a flat rate per square foot, and the actual expenses method, requiring detailed documentation․ Ensure the space is exclusively for business to qualify․ Proper documentation is essential to avoid audits and ensure compliance with IRS guidelines․ This deduction can significantly reduce taxable income for remote workers and small business owners․

2․2 Car and Vehicle Expenses

Car and vehicle expenses are deductible if used for business purposes․ This includes depreciation, gas, maintenance, and insurance․ The IRS allows two methods: actual expenses or the standard mileage rate․ Keep a mileage log to document business use, as commuting expenses are not deductible unless related to business activities like client visits․ Proper documentation is crucial to avoid audits and ensure compliance․ This deduction can significantly reduce taxable income for businesses reliant on vehicles for operations or client interactions․

2․3 Office Supplies and Equipment

Office supplies and equipment are deductible if they are used for business purposes․ This includes items like stationery, printers, desks, and computers․ Expenses must be ordinary and necessary for your business operations․ Keep receipts and records to support these deductions․ Proper documentation ensures compliance and avoids potential issues during audits․ This deduction helps small businesses offset the costs of maintaining an efficient workspace, contributing to overall financial health and profitability․ Accurate tracking is essential to maximize this deduction effectively․

2․4 Travel Expenses

Travel expenses related to business trips are deductible, including transportation, lodging, and meals․ However, personal expenses during trips are not deductible․ Meals are subject to a 50% limit, and documentation must detail business purpose․ Commuting costs are generally not deductible․ Ensure receipts and records are maintained to support these deductions․ Properly tracking travel expenses helps maximize tax savings and ensures compliance with IRS guidelines․ This deduction is essential for businesses with frequent travel needs, enhancing financial efficiency and reducing taxable income effectively․

2․5 Professional Fees and Services

Professional fees, such as legal, accounting, and consulting services, are deductible if they relate to your business operations․ This includes costs for tax preparation, bookkeeping, and financial advisory services․ However, personal legal fees are not deductible․ Ensure these expenses are documented and directly tied to business activities․ Proper documentation supports compliance with IRS guidelines, maximizing your tax savings․ Tracking these expenses helps small businesses reduce taxable income effectively while maintaining financial efficiency and adherence to tax regulations․

Documentation and Record-Keeping

Maintaining accurate records is crucial for verifying deductions and ensuring compliance with tax laws․ Use digital tools to track expenses and store receipts securely․

3․1 Importance of Proper Documentation

Proper documentation is essential for verifying deductions, ensuring compliance, and avoiding audits․ Accurate records of expenses, receipts, and invoices support claims and demonstrate adherence to tax laws․ Without proper documentation, businesses risk losing eligible deductions or facing penalties․ Maintaining organized files, both physical and digital, ensures easy access during tax preparation or audits․ Regularly updating records and using tools like expense tracking software can streamline the process and reduce errors․ Proper documentation is the foundation of a successful tax strategy for small businesses․

3․2 Tools for Tracking Expenses

Utilizing tools for tracking expenses is crucial for maintaining accurate records and maximizing deductions․ Digital apps like QuickBooks, Expensify, and Mint streamline expense monitoring, while spreadsheets can organize receipts and invoices․ These tools categorize expenses, generate reports, and ensure compliance with tax requirements․ Implementing automated solutions reduces errors and saves time, making tax preparation more efficient․ By integrating these tools into daily operations, businesses can easily reference their records when completing a small business tax deductions checklist, ensuring no eligible expenses are overlooked during tax filing․

Tax Deductions Checklist for Small Businesses

A comprehensive tax deductions checklist helps small businesses identify and organize eligible expenses, ensuring no potential savings are missed․ It covers payroll, office supplies, travel, and more, guiding businesses to maximize deductions effectively while maintaining proper documentation and meeting deadlines․

4․1 Printable PDF Checklist

A printable PDF checklist simplifies tracking small business tax deductions, offering a structured format to identify and verify eligible expenses․ It includes categories like home office deductions, car expenses, office supplies, travel costs, and professional fees․ By ticking off each item, businesses can ensure no deductions are overlooked․ The checklist also serves as a handy reference for gathering necessary documentation, making tax preparation efficient and stress-free․ Download and use it to maximize savings and stay organized throughout the year․

4․2 How to Use the Checklist Effectively

To use the small business tax deductions checklist effectively, start by reviewing each category and marking relevant deductions․ Ensure you understand what qualifies under each section, such as home office or travel expenses․ Gather supporting documentation for every item you claim․ Regularly update the checklist throughout the year to avoid last-minute scrambles․ Consider consulting a tax professional to verify accuracy․ By systematically tracking and verifying deductions, you can maximize savings and ensure compliance with IRS guidelines․ This organized approach streamlines tax preparation and reduces stress․

Maximizing Your Tax Deductions

Maximizing tax deductions involves identifying all eligible expenses, maintaining thorough records, and leveraging available resources like checklists and professional advice to ensure no potential deduction is missed․

5․1 Understanding Ordinary and Necessary Expenses

Ordinary and necessary expenses are the foundation of small business tax deductions․ An ordinary expense is common in your industry, while a necessary expense is essential for business operations․ Examples include rent, utilities, office supplies, and travel costs․ These expenses must directly relate to generating income and be reasonable in amount․ Proper documentation is crucial to support these deductions during audits․ Understanding this criteria ensures businesses comply with IRS guidelines and maximize their eligible write-offs effectively, avoiding unnecessary tax burdens and optimizing financial health․ Accurate classification of expenses is vital for compliance and savings․

5․2 Avoiding Common Mistakes

Avoiding common mistakes is crucial for maximizing tax deductions․ Many businesses overlook proper documentation, mixing personal and business expenses․ Others misclassify expenses or claim non-deductible items․ Ensure expenses are ordinary and necessary for your business․ Keep accurate records and avoid overestimating deductions․ Missing deadlines or failing to consult professionals can lead to lost savings․ Stay informed about IRS guidelines to prevent errors and ensure compliance․ Regular audits and organized documentation can help avoid disputes․ A well-prepared approach minimizes risks and maximizes tax benefits for small businesses․

Additional Resources

Explore IRS guidelines, tax preparation tools, and downloadable checklists to optimize your deductions․ Utilize resources like tax software and professional guides for accurate filing and compliance․

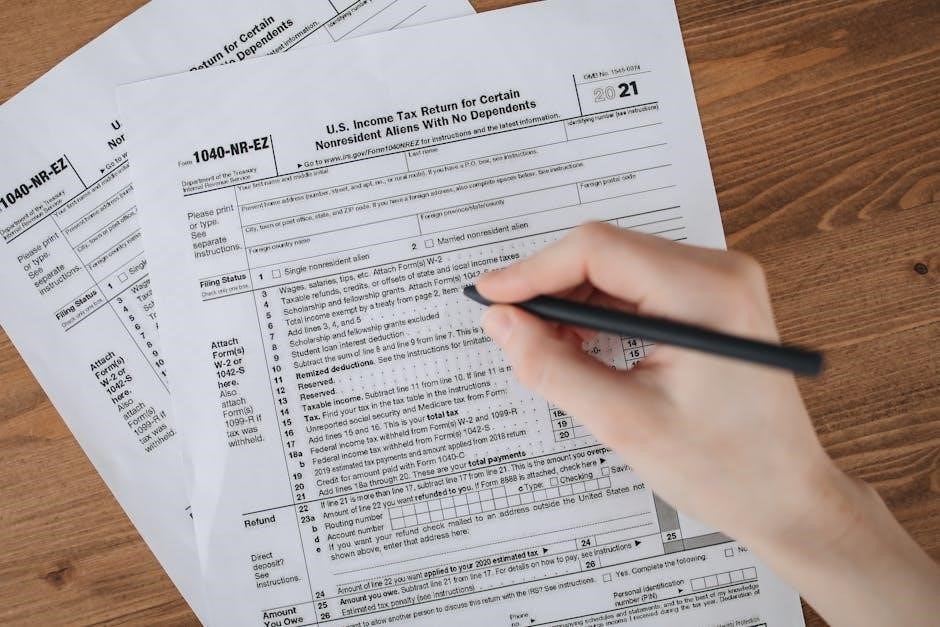

6;1 IRS Guidelines for Small Businesses

The IRS provides comprehensive guidelines for small businesses to navigate tax deductions effectively․ These resources outline eligible expenses, such as home office deductions, travel costs, and equipment purchases․ The IRS website offers detailed publications and forms, like Form 1040 and Schedule C, to ensure accurate reporting․ Small businesses can access these guidelines to understand what qualifies as an ordinary and necessary expense․ Regularly reviewing IRS updates helps businesses stay compliant and maximize their deductions․ Consulting IRS resources or tax professionals ensures accurate filing and avoids potential penalties․

6․2 Tax Preparation Tools and Software

Tax preparation tools and software are essential for small businesses to streamline deductions and ensure accuracy․ Tools like QuickBooks and TurboTax offer features to track expenses, categorize deductions, and generate reports․ These platforms often include checklists and guides specific to small business needs, helping owners identify eligible deductions․ Many tools integrate with IRS guidelines, ensuring compliance․ They also provide real-time tracking of expenses, reducing errors during tax season․ Leveraging these tools can save time and maximize deductions, making tax preparation more efficient and stress-free․